House Republicans have set off a political firestorm by introducing the groundbreaking SEC Stabilization Act, a bill that aims to remove Gary Gensler, Chairman of the SEC.

The bill, which has sent shockwaves through the financial community, is poised to ignite a fierce debate over the future of regulatory oversight.

As political tensions rise, stakeholders are bracing themselves for a clash of ideologies that will shape the trajectory of the SEC and the investment landscape.

Investors Sentiment

The online investment community has been abuzz with discussions about the proposed legislation to remove SEC Chair, Gary Gensler.

Retail investors, in particular, have taken to social media platforms to voice their opinions, and the prevailing sentiment strongly favors Gensler’s removal.

Game-Changing Legislation

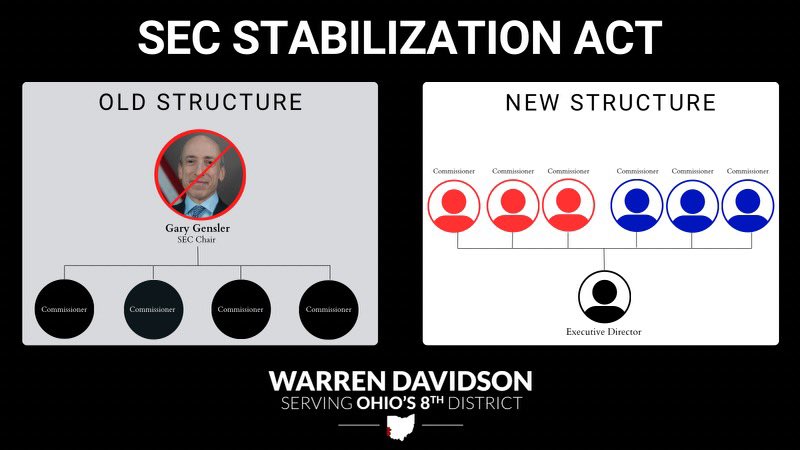

The proposed legislation, spearheaded by House Republicans Warren Davidson and Tom Emmer, seeks to oust Gensler from his position as SEC chair, citing concerns over excessive government intervention and stifled innovation.

Proponents argue that Gensler’s regulatory agenda has created an environment that hampers economic growth and inhibits business development.

They advocate for a more business-friendly and less intrusive regulatory approach, aiming to recalibrate the balance between oversight and economic freedom.

The introduction of this bill has triggered a passionate and divisive debate among lawmakers, financial experts, and industry stakeholders.

Potential Reshaping of the Investment Landscape

If the bill were to pass, it would mark a significant turning point in the SEC’s trajectory. A change in leadership would likely result in a shift in regulatory philosophy, potentially leading to a reevaluation of existing policies and initiatives.

Companies and financial institutions would face a different landscape, with revised enforcement priorities and a potential reduction in regulatory scrutiny.

Investors are closely monitoring these developments, as they could have far-reaching implications for market dynamics and investment strategies.

As the bill to remove Gary Gensler gains momentum, the future of regulatory oversight hangs in the balance.

The outcome of this battle will shape the direction of the SEC and the investment landscape for years to come.