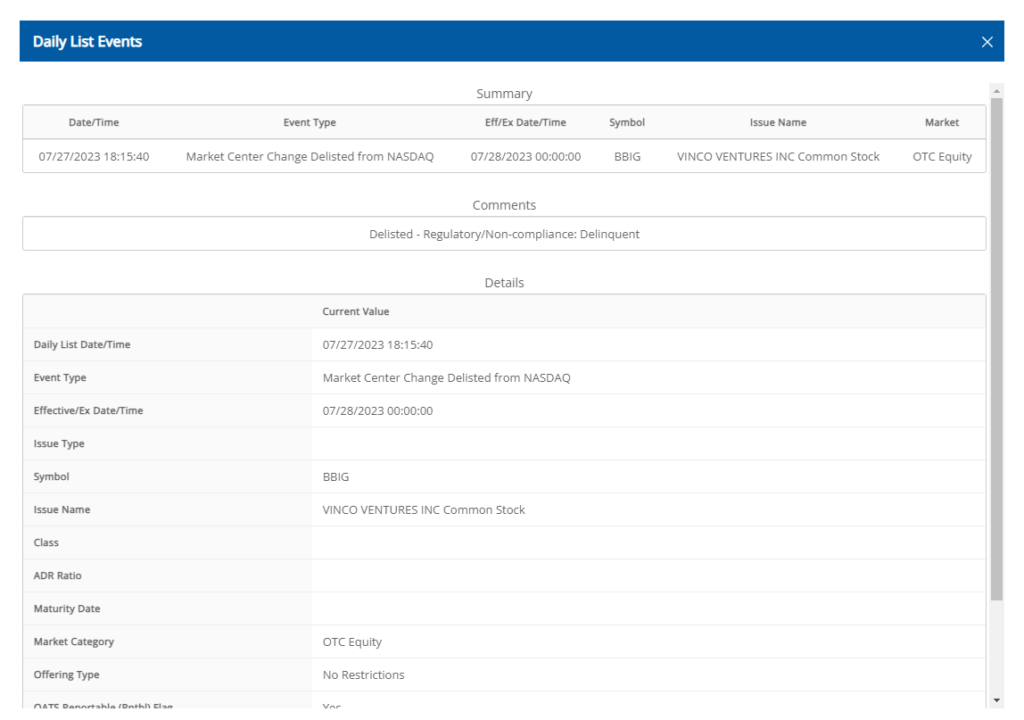

Vinco Ventures (NASDAQ: $BBIG) received a notice today from Finra stating Vinco will delist from NASDAQ effective July 28th.

This development arises as a result of the board of directors and executives’ inability to file the required Form 10-K for the period ending December 31, 2022, and Form 10-Q for the period ending March 31, 2023, within the designated timelines.

Retaining Mark Basile, Securities attorney

Today, during a recorded space call, Shad Vick and Christopher Muntz made an announcement stating that they have engaged Mark Basile from The Basile Law Firm, a Securities and RICO civil litigation firm.

The purpose of this engagement is to launch an investigation into potential claims, aiming to ascertain whether specific individuals have violated certain federal laws.

Mark Basile, who is working with $MMTLP, has been actively involved in the background alongside Shad and Muntz over the past few weeks.

This collaboration comes in the aftermath of their recent Nevada court hearing where they sought to appoint a receiver. However, Clark County Judge Nancy Allf denied this request based on procedural standings presented by the Defendants. (Case: A-23-868781-B)

GoFundMe

The updated GoFundMe states “To raise funds to pursue potential claims against parties that used VINCO (BBIG) for self-enrichment to the detriment of retail shareholders and to seek monetary damages consistent with our prospective claims under various federal and state law.”

Their goal is to raise an additional $350,000 to cover legal fees and expenses of multi-party federal court litigation.

“That money went somewhere, and it was all a scheme from the beginning to steal from us… we not sure what is going to happen moving forward…. but I do have a feeling of a bigger purpose and at the end of the day we going to get our reward,” stated Muntz.

5 Billion Dollar Valuation

Vinco Ventures, through its subsidiary ZVV (ZASH/Vinco Ventures), made a significant acquisition by purchasing a majority stake in Lomotif, a TikTok competitor, for $125 million.

As stated within SEC filings, the merger with ZASH Global Media and Vinco Ventures had a valuation of $5 billion dollars. To date the merger has never been completed.

In recent months, the company has garnered significant attention as multiple litigations have surfaced against its board of directors, executives, and Ted Farnsworth.

These allegations involve defrauding investors, money laundering, and claims of negligent fiduciary duties.

Vinco Ventures extended a loan exceeding 60 million dollars to ZASH Global Media for the purpose of funding and supporting the operations of Lomotif.

However, Lomotif has remained offline for the past 3 months. During the last shareholder meeting, the executives stated an ongoing server transition is in progress.

ZASH Global Media, co-founded by Ted Farnsworth holds a 50% stake in ZVV while retaining a 75% economic interest. Simultaneously, ZASH Global Media is facing legal action from fellow co-founders Jaeson Ma and Vincent Butta.

The lawsuit alleges a failure to comply with contractual terms in connection with ZASH Global (Case: A-23-869011-B)

Shareholders Unite

After this development came to light, shareholders have taken to social media to voice their concerns. A significant number of shareholders are seeking justice and coming together in unprecedented unity.